This article is excerpted from the FEE Daily, a daily email newsletter where FEE Policy Correspondent Brad Polumbo brings you news and analysis on the top free-market economics and policy stories. Click here to sign up.

The Biden administration recently announced yet another multi-trillion-dollar spending proposal: The “American Families Plan.” It would spend trillions subsidizing childcare, funding “free” community college, and much more. The White House justified the big spending push by arguing it would “build a stronger economy” by “invest[ing] in our kids, our families, and our economic future.”

Tonight, I introduced the American Families Plan — an ambitious, once-in-a-generation investment to rebuild the middle class and invest in America’s future. Learn more: https://t.co/9LHFuAWJsM

— President Biden (@POTUS) April 29, 2021

But a new Ivy League analysis concludes that Biden’s $2.5 trillion plan would have a negative return on investment.

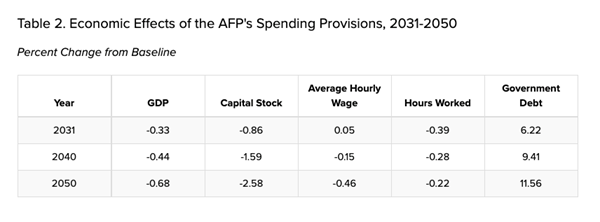

The Wharton School of Business evaluated its various spending and tax proposals and found that they would have the net effect of shrinking, not expanding, the economy. By 2031, Wharton estimates that the economy would be 0.34 percent smaller, investment would have decreased, hourly wage rates would have slightly increased, overall hours worked would decrease, and government debt would rise.

By 2050, the effects are even bleaker.

We’ve got to add to these bleak results the plan’s significant costs. The whopping $2.5 trillion price tag comes out to roughly $17,445 spent for every federal taxpayer. Just think of all the good that money could do if left in Americans’ pockets to begin with.

So how do politicians ever get away with big-spending bonanzas that fail a cost-benefit analysis? The answer lies in the fallacy of “the seen versus the unseen,” explained by economist Frederic Bastiat.

“[A] law gives birth not only to an effect but to a series of effects,” Bastiat wrote. Only the first effect is foreseen by policymakers and voters who fall victim to this fallacy, while the many second-order consequences remain unseen.

“It almost always happens that when the immediate consequence is favourable, the ultimate consequences are fatal, and the converse,” he continued. “Hence it follows that the bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come—at the risk of a small present evil.”

When it comes to Biden’s ambitious family spending plan, it’s easy to see the concrete ways some Americans would benefit in the short term. What unfortunately remains unseen in the eyes of many is how the long-term economic consequences of the plan would far outweigh and undermine any benefit.

Thankfully, Wharton just shined some light on this important reality.

Like this story? Click here to sign up for the FEE Daily and get free-market news and analysis like this from Policy Correspondent Brad Polumbo in your inbox every weekday.